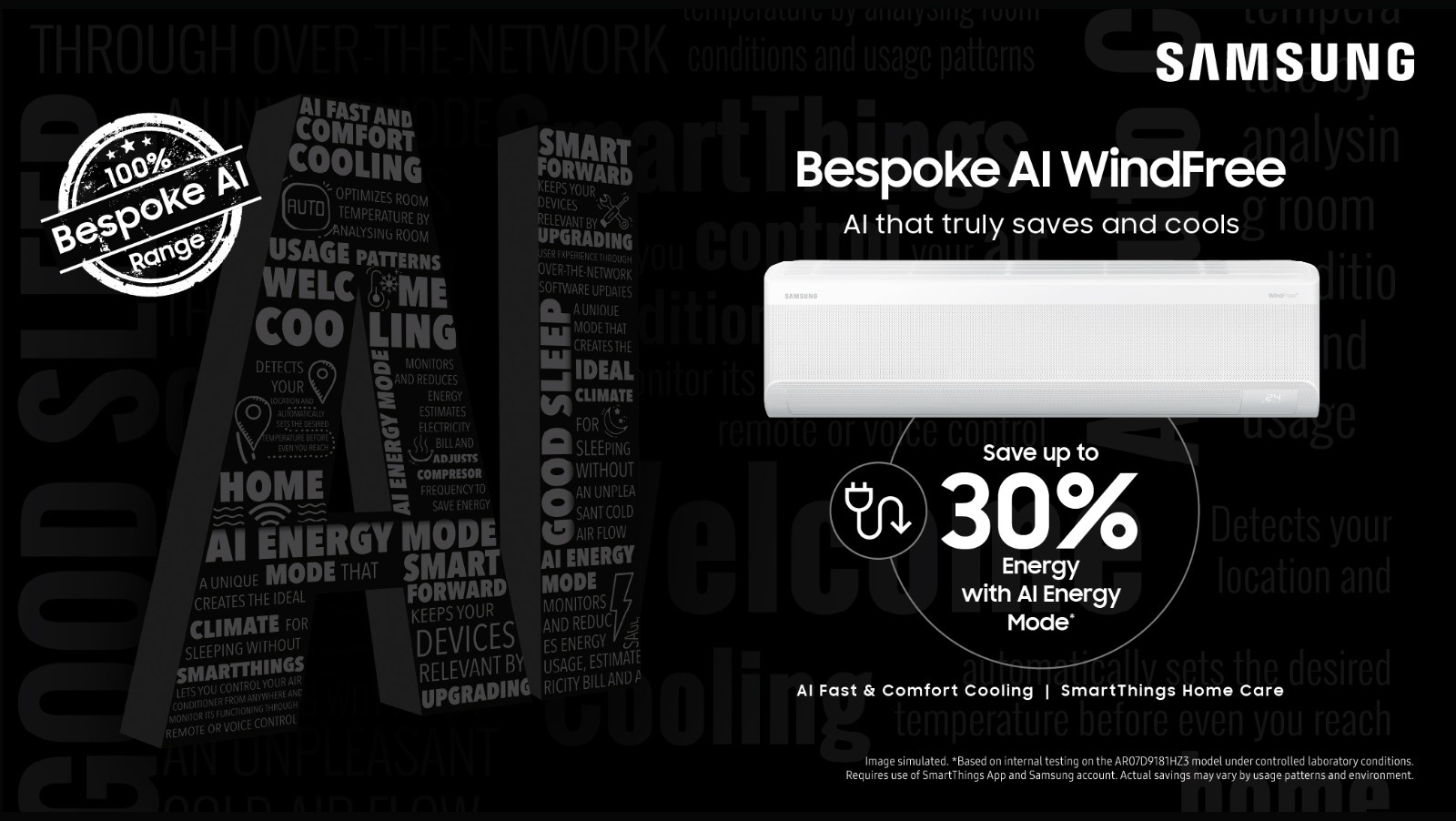

Samsung has launched its 2026 Bespoke AI WindFree air conditioner lineup in India, expanding its portfolio with 23 new models across categories, including the addition of 4-star variants. The launch reinforces Samsung’s push toward AI-led cooling, energy optimisation, and smart maintenance, but it also arrives at a moment when India’s room air conditioner market is being forced to recalibrate its growth assumptions.

After a year of uneven demand and shifting policy levers, the cooling category is entering what many brands see as a reset phase rather than a straightforward growth cycle.

A Market Still Shaken by Last Year’s Missed Heatwave

Last year was widely expected to be a defining one for air conditioners in India. Heatwave forecasts were aggressive, inventory planning followed suit, and brands entered the season with high expectations. The reality turned out to be more unpredictable. Unseasonal rains and a softer-than-expected peak summer disrupted sales momentum, leaving many brands short of their internal targets.

The takeaway for the category was clear. Weather alone can no longer be treated as a reliable growth driver. Demand volatility has become structural, not seasonal.

GST Relief Helped Brands Steady the Ship

The cooling market’s recovery owed more to policy than climate. The GST reduction on air conditioners eased pricing pressure at a critical time, improving affordability and helping deferred purchases convert, particularly in price-sensitive and emerging markets. For brands, it offered temporary breathing room and helped absorb rising input costs without pushing prices sharply higher.

That relief, however, now faces a new test.

2026 Brings BEE Pressure Back Into Focus

From January 2026, tighter BEE energy efficiency norms have reset how air conditioners are rated and priced. Models that previously sat comfortably in higher star categories now require more advanced components to maintain similar ratings, increasing manufacturing costs.

For consumers, this creates confusion around labels and value. For brands, it narrows pricing flexibility. While stricter norms promise better long-term energy savings, the short-term impact is higher entry prices in a category that remains deeply cost sensitive.

It is against this backdrop that Samsung’s 2026 lineup enters the market.

Samsung’s Bet on Intelligence Over Aggression

Samsung is not positioning this launch around aggressive pricing or raw cooling capacity. Instead, the Bespoke AI WindFree lineup leans heavily on intelligence-led differentiation. Features such as AI Fast Cooling, WindFree Cooling, AI Energy Mode, humidity-focused Dry Comfort, and SmartThings-based predictive maintenance form the core of the pitch.

The strategy reflects Samsung’s broader ambition in India’s AC market. The brand has been gaining traction and market share in recent quarters, but leadership in the category is still fragmented and highly competitive. This is less about rapid dominance and more about building credibility as a long-term player.

Where the AI Narrative Will Be Tested

In a reset year, AI is no longer a novelty. Consumers are increasingly asking what intelligence actually delivers in daily use. For Samsung, the success of this lineup will depend on how clearly energy savings translate into visible electricity bill reductions, especially as BEE norms push prices upward.

Humidity control may also emerge as a quieter but more relevant differentiator. Indian usage patterns are increasingly defined by long, humid months rather than short bursts of extreme heat. Features that prioritise comfort stability over aggressive cooling could shape repeat usage and long-term satisfaction.

Growth Exists, but the Margin for Error Is Smaller

There is room for Samsung to grow in India’s air conditioner market, but the path is tighter than previous cycles. The next phase of expansion will be driven less by headline launches and more by how effectively brands explain new energy labels, justify higher prices, and deliver consistent service experiences after installation.

Samsung’s 2026 Bespoke AI WindFree launch shows intent and continuity rather than reinvention. In a year defined by recalibration, that intent may matter as much as the technology itself.